Products

Buy Crypto

Assets

An integral part of the cryptocurrency universe, especially for those who are interested in Litecoin, is the 'Litecoin halving'. This event, which occurs approximately every four years, affects miners and investors alike due to its impact on the supply and price of Litecoin.

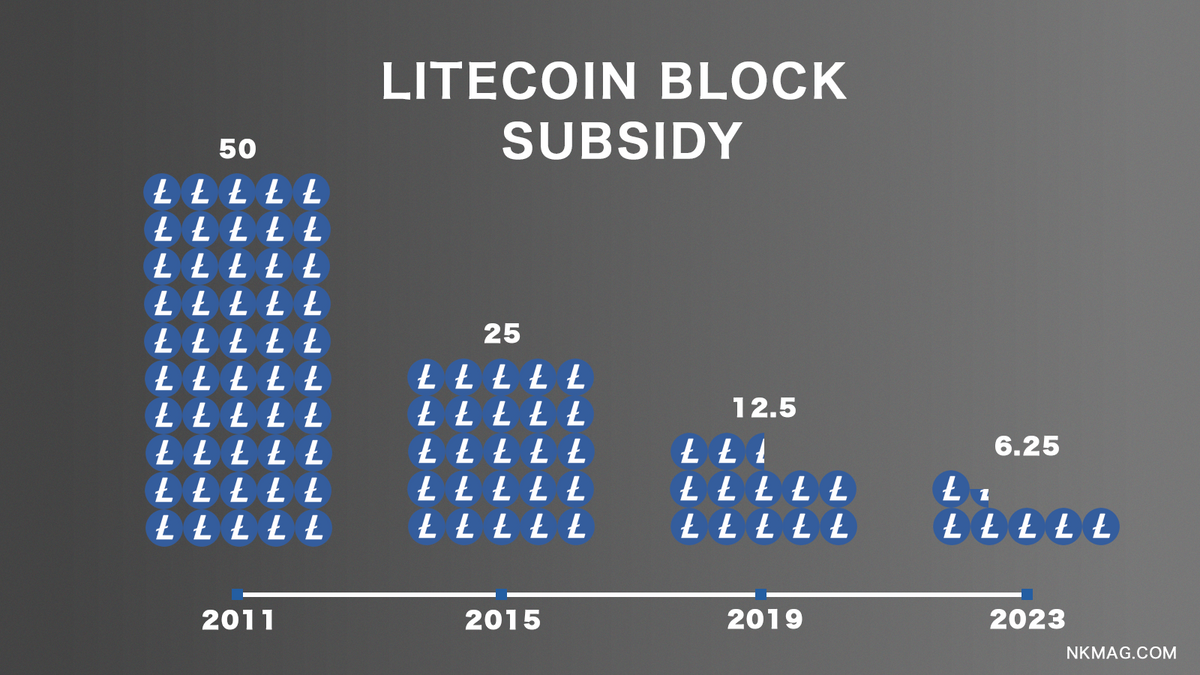

Litecoin halving is an event that happens every four years, reducing the block reward given to miners in half. The purpose of Litecoin halving is to control the supply of Litecoin, with the maximum amount that can be mined limited to 84,000,000. This mechanism prevents inflation and preserves the value of the cryptocurrency over time.

When a halving event occurs, miners who validate transactions and add them to the Litecoin blockchain receive a reduced reward for their effort. Essentially, this means that the same amount of computational work yields half the Litecoin it used to before the event.

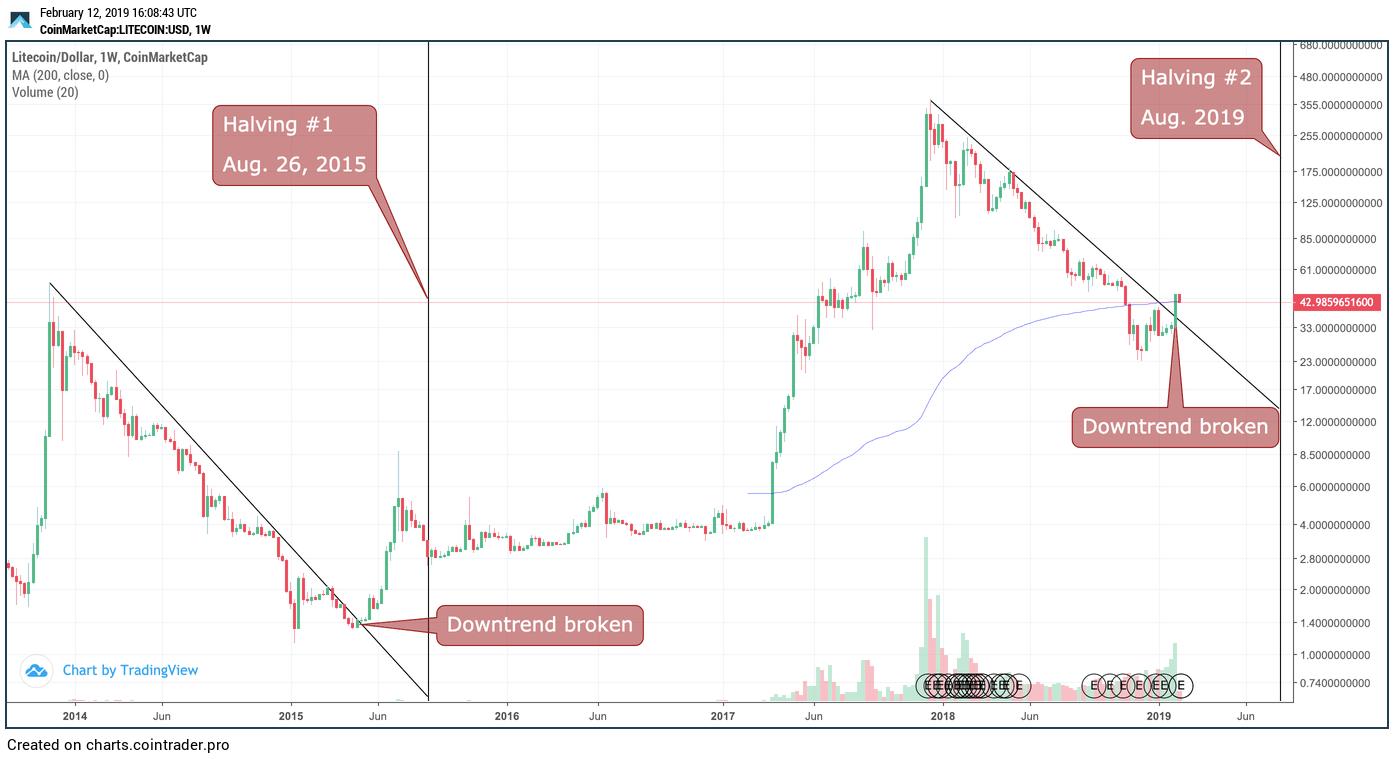

Since the inception of Litecoin, there have been two halving events. The first Litecoin halving took place on 25 August 2015, reducing the block reward from 50 LTC to 25 LTC. Following this event, the price of Litecoin experienced a significant surge, rallying by over 1,000%.

The second Litecoin halving occurred on 5 August 2019. In this event, the block reward was further reduced to 12.5 LTC. Similar to the first halving, the price of Litecoin rallied significantly in the period leading up to the halving, followed by a decline in the months that followed.

Understanding the concept of Litecoin halving and its impact on the crypto market is crucial for anyone interested in investing in or mining this cryptocurrency. As the next halving approaches, it's essential to stay informed and prepare for potential market changes.

Understanding the effects of Litecoin halving is crucial for both investors and miners. It influences the mining process and can potentially impact the price of Litecoin.

Litecoin halving directly affects the mining rewards. In simple terms, when a Litecoin halving event occurs, the reward for mining a new block on the Litecoin blockchain is cut in half. For example, Litecoin's block reward was initially 50 LTC but has now been reduced to 12.5 LTC after two halvings. The next Litecoin halving, which occurred on August 2, 2023, further reduced the block validation reward to 6.25 LTC.

This halving mechanism is designed to control the supply of Litecoin, with the maximum amount that can be mined limited to 84,000,000, thereby preventing inflation. For miners, this implies that the gains from mining Litecoin become less over time, which could potentially discourage miners if the mining costs outweigh the diminished rewards. For more insights on this subject, visit our guide on how to mine Litecoin.

Halving events can also have a significant impact on the price of Litecoin. Historical data shows that Litecoin's price experienced significant rallies following the previous two halvings. After the first halving, the price of Litecoin rallied by 14,200%, and after the second halving, it rallied by 1,574%.

However, it's important to note that these rallies were followed by significant price drops. In the 578 days following the first halving, the price declined by 73%, and in the 458 days after the second halving, it dropped by 83%.

While past performance is not indicative of future results, these trends provide some insight into potential price movements following a Litecoin halving event. Investors should keep these patterns in mind when considering to buy Litecoin around a halving event.

Remember, investing in cryptocurrencies carries risk, and it is vital to do your own research and make educated decisions. Understanding the potential impacts of Litecoin halving can help you navigate the crypto market more confidently.

The concept of 'halving' is a significant event in the life cycle of cryptocurrencies like Litecoin. It has a substantial impact on miners' rewards and often influences the market price of the cryptocurrency. Predicting and understanding these events are key to making informed investment decisions.

The most recent Litecoin halving occurred on August 2, 2023, reducing the block validation reward to 6.25 LTC. Looking ahead, the next Litecoin halving is projected to occur on July 30, 2027. At this time, the block reward will decrease from 6.25 LTC to 3.125 LTC.

These halving events continue approximately every four years until the rewards are effectively nonexistent, which is predicted to be around the year 2142.

Historically, Litecoin halving events have been associated with a marked increase in the price of the cryptocurrency in the months leading up to the event. This is often due to the expected reduction in supply, triggering an increase in demand among investors.

However, it's important to note that while historical trends can provide valuable insights, they are not a guarantee of future performance. The cryptocurrency market is influenced by a myriad of factors, and the impact of the next halving will be determined by the market conditions at that time.

As an investor, it's essential to stay informed about upcoming halving events and understand their potential impact on the market. By doing so, you can make more informed decisions and potentially take advantage of opportunities presented by these events.

To understand the concept of 'litecoin halving', we must first familiarize ourselves with the basics of Litecoin. This section provides a brief overview of Litecoin's origin, purpose, and the algorithm it uses for mining.

Launched in October 2011, Litecoin is the second-oldest cryptocurrency still in circulation, created by Charlie Lee, a former Google engineer. It was created from a fork of the Bitcoin blockchain, with modifications implemented to facilitate faster transaction speeds and lower costs. It is often referred to as the "silver" to Bitcoin's "gold", symbolizing its complementary role to Bitcoin.

Unlike Bitcoin, which uses the resource-intensive SHA-256 algorithm for mining, Litecoin uses the Scrypt algorithm. The Scrypt algorithm is less resource-intensive, allowing users to mine Litecoin on personal computers more efficiently and inexpensively.

This efficient mining process has made Litecoin a popular choice amongst cryptocurrency enthusiasts and miners. Its faster block generation speed, typically 2.5 minutes compared to Bitcoin's 10 minutes, allows for quicker transaction confirmations, making it an attractive option for everyday transactions.

In the context of 'litecoin halving', understanding the mining process and its algorithm becomes crucial. As we delve further into the topic, you'll see how halving events can impact the mining rewards and consequently influence the overall market dynamics.

A key aspect of understanding the phenomenon of Litecoin halving involves examining its impact on investors and the market at large. This includes studying investor expectations, market reactions, and the necessary precautionary measures for investors.

Historically, Litecoin has experienced price appreciation in the months leading up to the halving event. However, this increase in price was often followed by a significant correction after the halving. The price of Litecoin is influenced by various factors such as market sentiment, investor demand, and overall cryptocurrency market conditions, in addition to the halving event. Therefore, it is unlikely that the halving alone will drive immediate price gains.

Some cryptocurrency analysts believe that the impact of the Litecoin halving may be priced in, meaning that market participants have anticipated the event and its potential effects on price. This could further limit the immediate price gains following the halving.

The dynamics of the crypto market, particularly in relation to events such as Litecoin halving, can be quite volatile and unpredictable. It is therefore essential for investors to be adequately prepared and take precautionary measures.

While the reduction in the supply of new coins during a Litecoin halving event can create upward price pressure if demand remains stable or increases, it's also important to remember that multiple factors influence the price of cryptocurrencies. Therefore, investors should not base their investment decisions solely on the expectation of price increases due to halving events.

It is recommended that investors diversify their portfolios and invest only what they can afford to lose. Staying well-informed about market trends and developments, such as those discussed in our articles on what is Litecoin and how to mine Litecoin, can also help investors make sound investment decisions.

When considering to buy Litecoin or any other cryptocurrency, it is essential to understand the risks involved and to approach with caution. Seeking advice from financial advisors and conducting thorough research can also be beneficial in navigating the ever-evolving crypto landscape.

[1]: https://coindcx.com/blog/cryptocurrency/litecoin-halving-2023/

[2]: https://stormgain.com/blog/litecoin-ltc-halving

[3]: https://bitpay.com/blog/litecoin-halving/

[4]: https://www.litecoinhalving.com/

[5]: https://www.coindesk.com/markets/2023/08/02/litecoin-halving-unlikely-to-drive-immediate-price-gains-past-data-show/

Explore the Crypto Fear and Greed Index to enhance your trading strategies and market decisions. Learn more now!